Cohen & Company Capital Markets Continues Strong Momentum, Appoints Gary Quin Senior Advisor, EMEA Investment Banking to Expand Global Reach

MENLO PARK, Calif. and NEW YORK, Oct. 30, 2023 — Cohen & Company Capital Markets ("CCM") is pleased to announce the appointment of Gary Quin as Senior Advisor, who will lead CCM's efforts in Europe, the Middle East, and Africa (EMEA).

Gary brings a wealth of expertise to CCM, including over 25 years of investment banking, operating, and investing experience. His deep sectoral knowledge spans telecoms, media, digital infrastructure, real estate and financial services. Gary previously served as the CEO of North Atlantic Acquisition Corp (NAAC), a Nasdaq-listed SPAC with a primary focus on European acquisition opportunities. Prior to NAAC, he served as Vice Chairman of Credit Suisse's investment banking division in Europe, advising corporations, governments and governmental organizations, financial sponsors and family offices on M&A and capital raising. During his tenure at Credit Suisse, Gary successfully raised $66 billion in both private and public markets. Concurrently, he served as a Senior Advisor to the Blackstone Group. In the initial stages of his career, Gary gained experience at prominent companies like Digicel, Connolly Capital, and Blackrock Communications, as an operator and financier.

Gary's global track record also includes leading the capital raise for four blank check REIT IPOs with an aggregate value greater than €1.5 billion, advising the Irish Government on its €1.5 billion sale of Aer Lingus Group in 2015, advising on the $25.6 billion IPO of Aramco in 2019 and leading a €1.1 billion PIPE by Wilbur Ross, Fairfax Financial Holdings and Fidelity Investments. Additionally, during his time as a member of Melita Limited's Board of Directors, the company evolved from a pay-TV-centric cable operator into one of Europe's first fully integrated quadruple-play telecom operators.

"We are thrilled to welcome Gary to CCM. His broad expertise in advisory and capital raising will accelerate our growth and improve our international presence, specifically our reach in Europe, the Middle East and Africa," said Dan Nash, Co-founder, and Head of Investment Banking at CCM. "I've had the pleasure of working with Gary for many years, and I'm confident he will be a key strategic partner to our clients."

Gary added, "I'm honored to help lead CCM's global growth initiatives and look forward to working with their talented team to build on the firm's strong and growing momentum."

Gary holds an MBA from Trinity College Dublin, and an undergraduate degree from University College Cork, Ireland. He also pursued studies at Harvard Business School and the University of Oxford. Apart from his professional endeavors, Gary has a passion for rowing, as a former member of the Irish National Rowing Team.

CCM's Leading Capital Markets Platform

The previous year experienced increased volatility and multiple compressions in equity markets. This year volatility continues, with similar hurdles as interest rates rise and the market attempts to recover from two years of historically slow new issuance activity.

Entering the fourth quarter of 2023 and approaching the new year, despite the fact that markets and investors are encountering a theme of resistance marked by volatile equity performance, it is anticipated that this resistance will gradually normalize(1).

"We remain adaptable and resilient within the evolving financial landscape, reinforcing the strength of our position and ability to excel in dynamic market conditions. SPACs continue to offer a unique value proposition during this market dislocation, allowing flexibility to raise funds in creative ways," said Jerry Serowik, CCM's Co-founder and Head of Capital Markets.

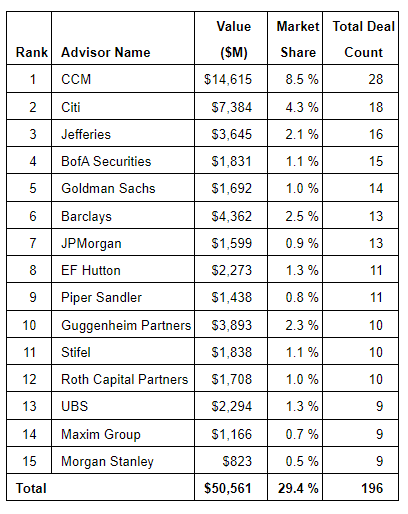

CCM continues to lead the market as the top DeSPAC advisor, and with limited traditional IPO activity, has remained the most active advisor navigating companies to the public markets over the last twelve months.

IPOs include all registered US listed IPOs over $20M in market value excluding SPAC IPOs between 10/1/2022 – 10/25/2023 and De-SPAC transactions include all De-SPAC transactions announced or closed between 10/1/2022 – 10/25/2023 (2)

Additional Team Updates

As CCM continues its growth, they have further expanded their team with the addition of the 2023 junior team and other recent additions.

Meryl Anderson, Investment Banking Analyst, graduated Magna Cum Laude with a BS in Finance from The Ohio State University's Max M. Fisher College of Business.

Vera Xing, Investment Banking Analyst, holds a BS in both Mathematics and Economics from the University of Michigan, Ann Arbor.

Lauren Raimondo, Business Operations and Marketing Analyst, holds BA from Harvard University and graduated Summa Cum Laude with a MS in Business Management and Entrepreneurship from Babson College's Olin Graduate School of Business.

Rachel Shehy, Business Operations and Administrative Assistant, 10+ years experience, most recently from Resilience Lab.

About Cohen & Company Capital Markets

Cohen & Company Capital Markets ("CCM"), a division of J.V.B. Financial Group, LLC, has offices in Menlo Park, Calif. and New York City. CCM was founded in 2021 and has established itself as an elite full-service boutique investment banking firm with differentiated product expertise and bulge bracket DNA. We partner with leading and emerging companies across sectors to address strategic and financial opportunities, and leverage a strong reputation, broad network, and superior execution to serve our clients' interest first and always. CCM's indirect parent is Cohen & Company Inc. (NYSE American: COHN).

Citations

(1) SPAC research, Bloomberg; Market data as of 10/3/2023

(2) SPAC Insider; Data as of 10/25/2023

Media Contact:

Lauren Raimondo

LRaimondo@Cohencm.com